| Informational Websites | ChronoMaddox -- the legacy of Chuck Maddox | OnTheDash -- vintage Heuer website | Zowie -- Omega information |

| Discussion Forums | ChronoMaddox Forum | Heuer Forum | Omega Forum |

| Counterfeit Watchers | ChronoTools Forum | ChronoTrader Forum |

|

|

The largest independent, non-commercial, consumer-oriented resource on the Internet for owners, collectors and enthusiasts of fine wristwatches. Online since 1998. | |||||||

|

||||||||

|

||||||||

|

Vintage Heuer Discussion Forum

The place for discussing 1930-1985 Heuer wristwatches, chronographs and dash-mounted timepieces. Online since May 2003. | ||||||

| |||||||

| |||||||

Happened to the esteemed Rolex when they overheated some years back and Omega after Omega Mania! Where are their prices now? The best and rarest watches will continue to prosper over the medium term, short term is always subject to fluctuations like any kinda market. Do we think AAPL shares will be in the $1.40s in 2 years time...

This John Reardon guy is clearly no sage just reporting what is in the rear view mirror, no skill in that and as the man below suggests judging a market on the many poor examples they sold recently is not clever. I’ve been buying watches from auctions since early 2000s and none of these guys are experts, only interested in volume, commission etc. They all end up working for themselves after they’ve made a “name” anyways bet this guy will too ;)

Summary is ya’ll should chill !

Broomie

: Well, this seems a bit odd to me . . .

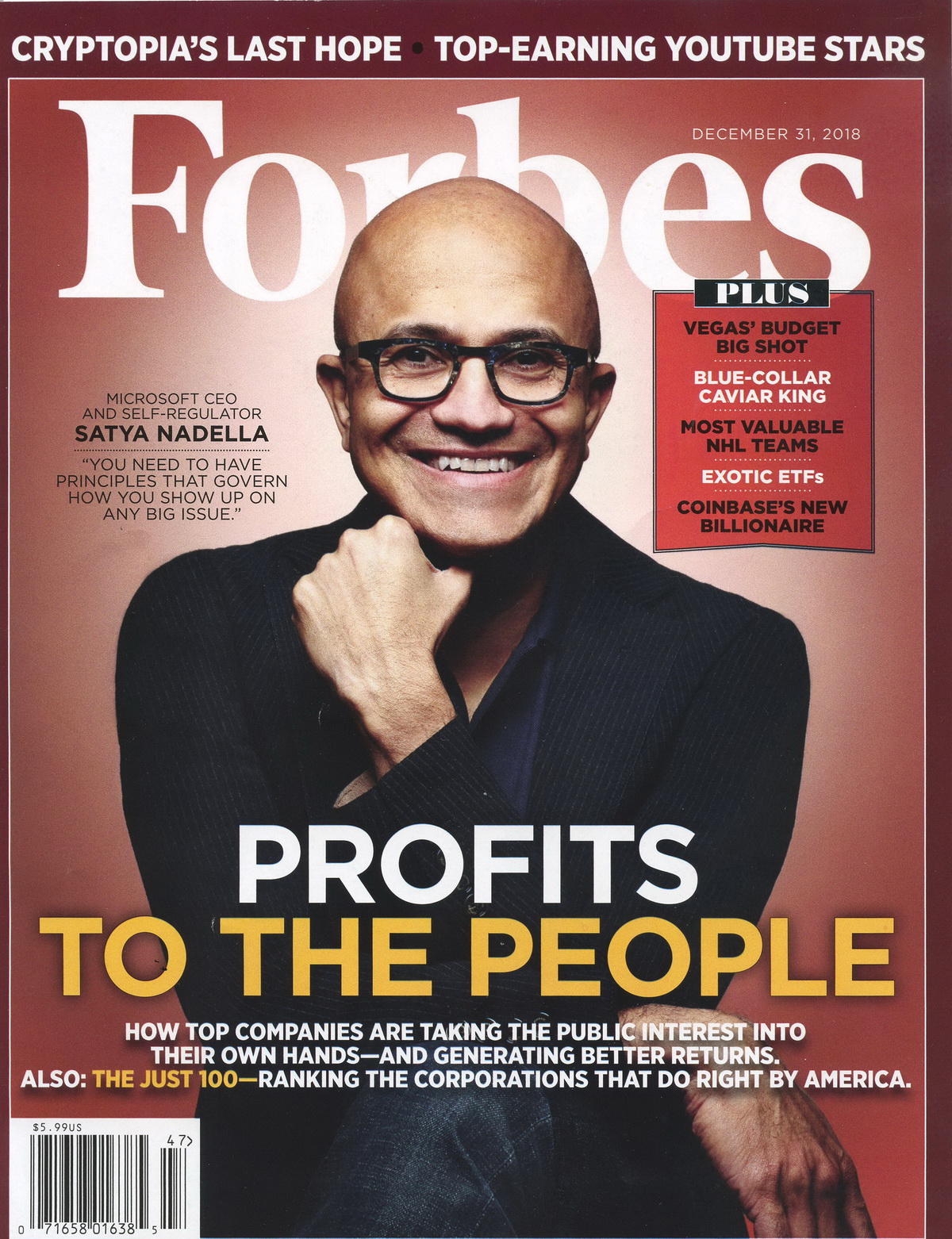

: Current issue of Forbes magazine has John Reardon, of head of

: watches at Christie's, offering his buy / hold / sell

: recommendations for watch investments.

: Buy? Rolexes selling at under $10,000, for example, the GMT Master

: II model . . . well that seems reasonable. Not the most daring

: or unusual investment advice, but maybe that's what you get in a

: $5.99 magazine.

: Hold? 1950s Patek Philippe watches with Cloisonne Enamel dials

: (valued in $500,000 range and up) . . . some excellent advice

: for all the Forbes readers who happen to have these watches in

: their portfolios. Yes, continue to hold these watches. Don't

: load up on them, and don't sell them, but continue to hold them.

: Yes, will do!!

: Sell? Vintage Heuers!! Because speculators have driven prices to

: record highs of $100,000, so you should sell now, before the

: bubble bursts.

: Regarding the Heuers, I had to wonder whether Mr. Reardon might

: have written this column 18 months ago, with it being delayed in

: the mail since then? I mean, Summer 2017 was probably the high

: water mark for the vintage Heuers (say, the June 2017 Christie's

: auction in New York City), and the market has corrected / slid

: since then.

: Is he really suggesting that people who own the Heuers should sell

: now, after the correction? I thought that we are supposed to buy

: when prices are low and sell when they are high? Or are we

: supposed to bail out, when prices are down?

: This was puzzling to me . . . How do others see it?

: Jeff

:

:

:

:

| Chronocentric and zOwie site design and contents (c) Copyright 1998-2005, Derek Ziglar; Copyright 2005-2008, Jeffrey M. Stein. All rights reserved. Use of this web site constitutes acceptance of the terms of use. | CONTACT | TERMS OF USE | TRANSLATE |